Many expats, non-residents, and non dom individuals do not yet realise that UK tax changes starting in 06 April 2026 could increase the amount of tax they pay. For those with overseas income, these changes may affect savings, investments, and future financial plans.

The UK government has announced a major shift in how foreign income is taxed. At the centre of these changes is the new Foreign income and gains regime, which is set to replace the current non-dom system from 6 April 2025. This new approach will change how overseas income and gains are reported and taxed for people living in or connected to the UK.

The Foreign income and gains regime is a new UK tax framework that removes the remittance basis and brings foreign income into the UK tax system after a fixed period of residence.

This blog explains what the foreign income and gains regime means, how the non dom tax rules are changing, who is likely to be affected, and what steps you can start taking now. If you are an expat, a non-resident, or involved in a small business with overseas income, this guide will help you understand what to expect before 2026.

What is the Foreign Income and Gains (FIG) Regime?

The Foreign income and gains regime is a new UK tax system that determines how foreign income and overseas gains are taxed for individuals who are not originally from the UK. It is designed to replace the long standing non dom remittance basis.

Under the current system, non dom individuals can choose to pay UK tax only on income brought into the UK. The Foreign income and gains regime removes this option and introduces a residence-based model. This means foreign income and gains will become taxable in the UK once a person has lived in the UK for a certain number of years.

The aim of the foreign income and gains regime is to simplify tax rules and ensure consistency. However, it also means that many expats and non dom individuals may face higher tax liabilities. Understanding how this regime works is essential for anyone with overseas assets, foreign investments, or income earned outside the UK.

Understanding the Changes to Non-Dom Tax Rules Under the New FIG Regime

The move to the foreign income and gains regime brings several important changes for non dom individuals. These changes will affect how income is reported, taxed, and planned for. (effective from 6 April 2025).

1. End of the Remittance Basis

The remittance basis will no longer be available. Foreign income will be taxed in the UK regardless of whether it is brought into the country.

2. Residence Based Taxation

Tax liability will depend on how long you have lived in the UK. After a qualifying period, overseas income will be fully taxable under the foreign income and gains regime.

3. Four Year Exemption Period

New arrivals to the UK may benefit from a four-year exemption on foreign income and gains, provided they have not been UK tax resident in the previous ten years.

4. Overseas Assets Brought Into UK Tax Net

Income from foreign property, dividends, and overseas savings will fall under UK tax once the exemption period ends.

5. Trust Structures Affected

Many offshore trust arrangements may lose their tax protection. Income within trusts could become taxable for UK resident beneficiaries.

6. Increased Reporting Requirements

HMRC will expect more detailed reporting of foreign income, bank accounts, and overseas investments.

7. Capital Gains on Overseas Assets

Gains from selling overseas assets will be taxable in the UK under the Foreign income and gains regime. (with 2019 rebasing for qualifying pre-2025 assets).

8. Impact on Long Term Residents

Individuals who have lived in the UK for several years will be fully within the new regime with limited relief options.

These changes mark a clear shift in UK tax policy, with transitional relief like the Temporary Repatriation Facility (TRF) at 12-15% for pre-2025 unremitted income.Early planning is key to managing exposure under the foreign income and gains regime.

How Will the New FIG Regime Affect Expats and Non-Residents in the UK?

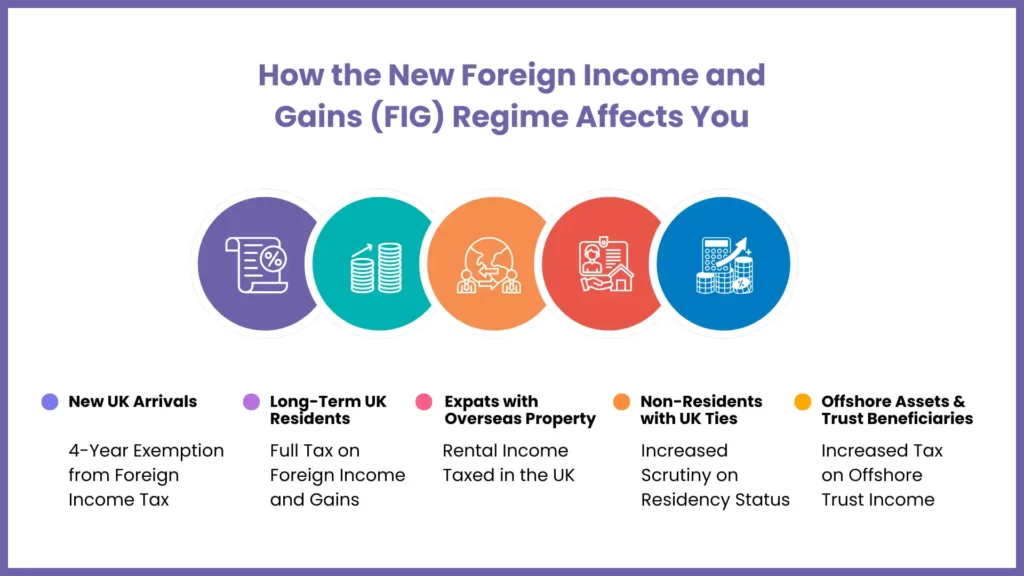

The Foreign income and gains regime will affect expats and non-residents in different ways depending on residency status, income type, and length of stay.

| Category | Impact Under the FIG Regime |

| New UK arrivals | Possible four-year exemption on foreign income |

| Long-term UK residents | Full tax on foreign income and gains |

| Expats with overseas property | Rental income taxable in the UK |

| Non-residents with UK ties | More scrutiny on residency status |

| Individuals with offshore savings | Interest income taxed in the UK |

| Overseas investments | Capital gains taxed on disposal |

| Trust beneficiaries | Reduced protection from UK tax |

| Small business owners | Overseas profits may become taxable |

These changes mean many people will need to rethink their tax planning. Reviewing residency status and overseas income sources is essential before April 2026.

What Are the Key Changes to Foreign Income and Gains Starting 6 April 2026?

From 6 April 2026, the foreign income and gains regime will come into force. This will bring major changes for people who earn income or hold assets outside the UK. The new rules will affect how foreign income is taxed, what needs to be reported to HMRC, and how closely overseas income is checked.

Removal of the remittance basis

The option to be taxed only on foreign income brought into the UK will end. Under the Foreign income and gains regime, overseas income and gains will become taxable in the UK once the exemption period finishes.

Introduction of transitional rules

Some existing non dom individuals may qualify for short term transitional relief. This may reduce tax on previously untaxed foreign income, but the relief is limited and time bound.

Higher reporting requirements

You will need to share more details with HMRC about your overseas bank accounts, foreign income, and any foreign assets you sell.

Taxation of overseas capital gains

If you sell property, shares, or other assets outside the UK, any profit you make will be taxed under normal UK capital gains tax rules.

Stronger HMRC compliance checks

HMRC is expected to increase checks on overseas income reporting. Mistakes, late filings, or missing information under the foreign income and gains regime may result in penalties.

Preparing early for these changes allows individuals to review their tax position, organise records, and reduce the risk of unexpected tax bills once the new rules apply.

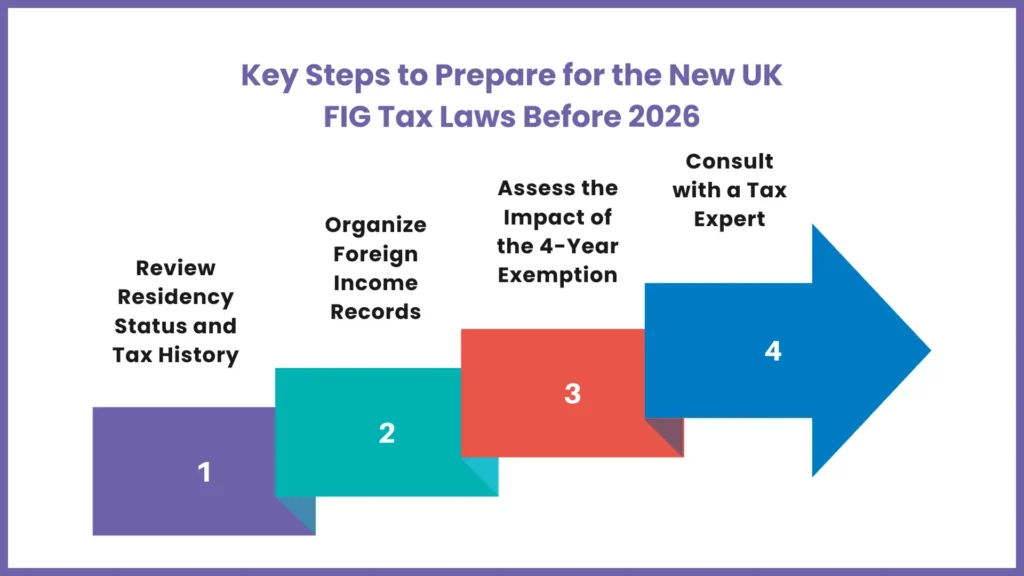

Practical Steps: How Expats, Non-Residents, and Non-Doms Can Prepare for the New FIG Regime

Preparing for the Foreign income and gains regime requires planning and clear records.

1. Review Residency Status

Check your UK tax residency history to understand when the new rules apply to you.

2. List All Foreign Income Sources

Create a full record of overseas income, including rent, dividends, and interest.

3. Assess Overseas Assets

Review foreign property and investments to understand potential capital gains exposure.

4. Consider Timing of Income

Where possible, review whether income or asset sales can be planned before April 2026.

5. Update Record Keeping

Ensure bank statements and overseas income documents are accurate and accessible.

6. Review Trust Arrangements

If you are involved in offshore trusts, review how the foreign income and gains regime affects them.

7. Seek Professional Advice

Tax rules are changing quickly. Professional guidance helps avoid errors.

Taking these steps now can reduce stress and improve compliance later.

How MyIVA Can Help You Navigate the New FIG Regime?

Understanding the Foreign income and gains regime is important because mistakes can lead to penalties and unexpected tax bills. Expert support makes a real difference.

1. Personal Tax Reviews

MyIVA reviews your tax position and explains how the new regime applies to you.

2. Foreign Income Reporting

Accurate reporting of overseas income to meet HMRC rules.

3. Residency Status Assessment

Clear guidance on UK tax residency and exemption periods.

4. Capital Gains Calculations

Support with overseas asset disposals and gains reporting.

5. Trust and Investment Guidance

Help understanding how offshore structures are affected.

6. HMRC Compliance Support

Ensuring filings are accurate and submitted on time.

7. Ongoing Advisory Support

Dedicated experts who understand small business and individual tax needs.

Partnering with MyIVA means having clear guidance and reliable support during this transition.

Get Ready for the New Foreign Income and Gains Regime – Contact MyIVA Today

Stay ahead of the changes before April 2026. Our experts will guide you through the new rules and help ensure your compliance.

FAQs: Frequently Asked Questions

What is the foreign income and gains regime?

It is a new UK tax system that taxes foreign income based on residence rather than remittance.

When does the new FIG regime start?

The main changes under the foreign income and gains regime will apply from 6 April 2026, and from this date the current non dom tax rules will no longer apply.

Will non dom status still exist?

No. The existing non dom system, including the remittance basis, will be removed and replaced fully by the foreign income and gains regime.

Is there any exemption for new arrivals?

Yes. Some new UK residents who have not been UK tax resident in the previous ten years may qualify for a four-year exemption on foreign income and gains.

Do I need to report overseas income now?

Yes. Keeping clear and accurate records of overseas income, assets, and bank accounts is important now to prepare for the foreign income and gains regime.

Conclusion

The Foreign income and gains regime is a major change to UK tax rules. Expats, non-residents, and non dom individuals with overseas income need to understand how these changes apply to them.

If you do not prepare in time, you may face higher tax bills or HMRC penalties. Taking action early gives you time to review your income, overseas assets, and residency status under the new rules.

MyIVA supports individuals and small business owners with clear advice, accurate tax filings, and ongoing tax support. If you need help preparing for the foreign income and gains regime, speak to MyIVA today and stay compliant with confidence.

Contact MyIVA now to get expert guidance before April 2026.